I would like to request a quote for

Mining

Mining’s Next Chapter

Leading mining organisations are reframing risk management from a defensive necessity into a driver of value.

By using data and analytics, leveraging alternative risk transfer and aligning risk financing with business goals, resilience becomes a competitive advantage.

GRMS

Economic Slowdown

Economic slowdown has been ranked the top risk facing South African organisations. With trade tensions, inflation and geopolitical instability in play, resilience is no longer optional - it’s strategic.

GRMS

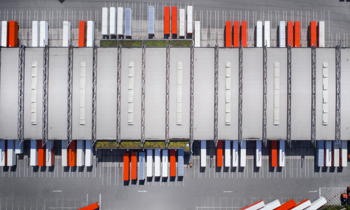

Supply Chain Failure Ranks 7th in Aon Global Risk Management Survey

In an era of volatility, one thing is clear: Supply chain resilience is now directly linked to business continuity and competitiveness. Organisations that understand their vulnerabilities, map their exposures and adopt agile, data-driven strategies are the ones best positioned to thrive.

Risk Consulting

The Complete Risk Manager

Insurers may set the terms - but your risk profile determines how they see you. When risk becomes a competitive advantage, organisations gain visibility, control and long-term cost efficiency.

Professional Indemnity

The Unsung Hero of Engineering Success

Innovation and risk go hand in hand - especially in engineering. That’s why Professional Indemnity (PI) insurance is more than a safety net. It’s a catalyst for progress.

Healthcare

Futureproofing Your Access to Quality Healthcare

More consumers are adopting a hybrid healthcare funding strategy — combining a medical scheme, gap cover and primary health insurance for a more complete and cost-effective solution. While no single product meets everyone’s needs, a professional healthcare broker can help you strike the right balance between benefits, cost and long-term sustainability.

Healthcare

Building a Future-Ready Workforce

To retain top talent, organisations must take a data-led approach to total rewards - aligning benefits, wellbeing and development with business goals.

Affinity

Ready, Set, Relax

Before you pack your bags or hang up your decorations, take a few minutes to review your insurance policies and safety plans.

A quick check now could save you major stress later — helping you enjoy a worry-free festive season knowing your home, belongings and health are protected.

GRMS

Economic Slowdown Remains Top Business Risk for South Africa, Aon's Global Study Finds

Economic slowdown remains a main concern in South Africa with 78% of respondents that have suffered a loss as a result, while political risk climbed three places to the second most pressing risk for businesses.

Cyber

The Effect of Cyber Risk on SMBs

Aon South Africa’s latest SMB Cyber Risk Report uncovers how digital threats are evolving and what SMBs can do to stay resilient in the face of rising cyber risks.

Mining

Competitive, Responsible Mining

One accusation can change everything.

In today’s world of healthcare and professional services, professionals are held to higher standards — and claims of negligence, whether valid or not, are on the rise.

Professional Indemnity

The Strategic Value of Early Reporting

One accusation can change everything.

In today’s world of healthcare and professional services, professionals are held to higher standards — and claims of negligence, whether valid or not, are on the rise.

Specialty

Reframing Marine Cargo Risks

Cargo keeps global trade moving — but it also carries risk. In today’s volatile economy, traditional insurance often struggles to keep up with trade disruptions, tariffs and weather volatility.

Affinity

The Importance of Pet Insurance

Whether you’ve got a curious kitten, a senior dog or a breed prone to health issues, pet insurance should match your pet’s unique needs.

Construction and Engineering

AI Spurs Wave of Data Centre Growth in Africa

The rise of generative AI is fuelling unprecedented demand for cloud services — and data centres are at the heart of this surge.

With South Africa, Kenya and Nigeria attracting major global investment, Africa is fast becoming a critical hub for digital infrastructure. But with growth comes new risks: power shortages, land constraints, sustainability demands and more.

Personal Lines

Spring Clean Your Insurance Covers

Spring isn’t just for your home – it’s for your insurance too!

As you declutter cupboards and dust off shelves, take a moment to review your insurance policies.

M&A

Navigating Buy-Side Success in a Shifting M&A Landscape

Read Aon’s latest insights from Zamani Ngidi on how to navigate today’s complex deal-making landscape.

Aon Protect Personal Travel Insurance

Are you Traveling abroad?

Get Aon Protect Personal Travel Insurance

Severe Weather

Protecting Your Home from Severe Weather

In 2024, global natural disasters caused $368 billion in losses. Shockingly, only $145 billion was insured. Flooding is one of South Africa’s biggest risks, with above-normal rainfall expected in the east and southeast this spring, is your home — and insurance — ready for the storm?

Directors and Officers

D&O Laundry list

Corporate leaders are under the microscope—not just for profits, but for values, ethics and commitments. Enter a new challenge: corporate “washing.” From greenwashing to AI washing, misleading claims can expose directors to lawsuits, regulatory scrutiny and reputational harm.

The stakes are high: one misstep could mean costly litigation and personal liability.

Asset Valuation

Asset Valuation Unpacked

Knowing the Estimated New Replacement Cost (ENRC) of a business’ assets helps them to avoid costly surprises — whether insuring buildings, machinery or equipment.

Directors and Officers

Responding to Cyber Attacks

Cyber threats aren’t just an IT problem — they’re a boardroom issue. Directors are increasingly being held personally liable for mismanaging cyber risks, with AI introducing new threats. Make sure your D&O policy is aligned with your Cyber insurance. Both are essential for total risk protection.

Transport and Logistics

Climate Volatility Disrupts Global Supply Chains

According to Aon’s 2025 Client Trends Report, extreme weather events and climate shifts are disrupting global trade routes and exposing businesses to massive financial risk. Is your supply chain strategy keeping pace with climate change?

Tax Risk Insurance

Are You Prepared for a Tax Audit?

With SARS ramping up audits using AI and increased funding, up to 25% of tax returns could be flagged for review. Even if your taxes are 100% accurate, you could still be audited and responding takes time with added costs in professional fees.

Find out more about our Tax Risk solution

Global Cyber Risk Report

Aon's 2025 Global Cyber Risk Report

Local insight, global data. Understand what cyber risk means for businesses in South Africa and beyond.

Construction and Engineering

Construction Insurance and Surety Market Outlook

The global construction insurance market is showing cautious optimism in 2025, with increased insurer capacity and booming infrastructure projects. But it’s not all smooth sailing – natural disasters, economic uncertainty and supply chain disruptions are testing resilience.

Medical Malpractice

Consent: A Cornerstone of Professional Ethics in Healthcare

Informed consent in healthcare is more than paperwork—it’s a cornerstone of ethical medical care. It protects patient autonomy, upholds dignity and builds trust between healthcare providers and their patients. Consent ensures that patients understand and voluntarily agree to their treatment options.

SRE

Lights, Camera… Risk?

Film production may be glamorous, but behind the scenes, crews face serious real-world threats—from equipment theft to cybercrime and even location-specific dangers. As productions become more mobile and tech-driven, it’s never been more important to think about risk.

Cyber

Artificial Intelligence in Insurance

Artificial Intelligence (AI) risks go far beyond hardware failures. Think financial losses, reputational damage, discrimination and privacy breaches — all possible from automated decision-making systems. Understanding non-physical and systemic AI exposures is key to offering future-ready insurance solutions.

SRE

When Your Star Performer is a No-show

Even the best-planned events can encounter disruptions. Whether it’s illness, injury or travel delays, a no-show from a star performer can lead to serious financial losses.

Cyber

Fraud and Your Bank Account

Online shopping, bill payments and banking are now integral to our daily lives. But with this convenience comes risk.

Marine

Marine Insurance: Trends and Challenges

In today’s dynamic global trade environment, marine insurance is more crucial than ever. As highlighted in Aon’s 2024 Client Trends Report, businesses face interconnected risks like geopolitical instability, inflation and climate change. These factors are reshaping trade channels and impacting insurance claims. Stay informed and protect your assets by understanding the evolving challenges in marine insurance.

Trade Credit Solutions

Evolving Macro Trends in the Credit Solutions Market

A single unpaid invoice from a key client can threaten your business liquidity. From global geopolitical tensions to rising insolvency rates and the rapid evolution of AI, today’s macroeconomic landscape is more volatile than ever. Find out how trade credit insurance can help in Maria Teixeira’s latest article.

M&A and Transaction Solutions

Creating Value in Portfolios Leveraging Four Key Levers

In today’s uncertain market, private equity firms need a strategic approach to extract value from their portfolios. Zamani Ngidi, our Business Unit Manager for M&A and Cyber Solutions, highlights four essential levers that financial sponsors can pull in his latest article.

Risk Management

Navigating Political Risks in a Volatile World

Political instability, terrorism and civil unrest continue to pose serious threats to businesses. As risks escalate across Africa and globally, organisations must adapt to uncertainty and safeguard their resilience.

Risk Management

Closing the Gap in the Energy Market

Emerging technologies are key, but they also bring new risks and uncertainties. That’s why tailored risk management is crucial for the future of renewables.

M&A

Effectively Managing Deal Risk to Secure Investments and Enhance Returns

Smart Risk Management in M&A:

Investors are no longer just looking for insurance policies—they want real recovery when things go wrong. In his latest article, Zamani Ngidi, our Business Unit Manager for M&A and Cyber Solutions, looks at how organisations can effectively manage deal risk to secure investments and enhance returns.

Report

Aon South Africa Impact Report 2024

Aon is committed to continue to impact opportunities and growth through diversity and inclusion plans and initiatives. View the 2024 Impact Report & Transformation Agenda

ESG

Managing Mining Risk in a Rapidly Transforming World

The mining industry is at the forefront of the global energy transition, supplying essential materials for renewable energy technologies. But with great opportunity comes great responsibility. From climate change to geopolitical risks, the challenges are complex.

ESG

Managing Increased Volatility to Build Resilience and Capture Growth in Mining

Data holds the key to unlocking smarter decisions in mining. With interconnected risks—from geopolitical challenges to ESG compliance—mining leaders must take an enterprise-wide approach to risk management. Discover insights from Paul Pryor on mining insurance market trends and strategies to stay ahead.

Cyber

AI Driving Efficiencies in Mining

As the mining sector prepares for the next frontier of technological advancements, digital tools and sophisticated data analytics will be crucial for staying ahead of current and future risks. With the pace of change accelerating, technology—if harnessed and managed correctly—can serve as a catalyst for businesses to achieve their growth ambitions

Renewable Energy

Navigating Financial Exposures in Renewable Energy Projects

Unlocking the potential of renewable energy projects requires more than innovation; it demands strategic risk management. Santesh Pillay from our renewable energy and construction team illuminates the importance of a pre-agreed insurance policy for de-risking challenges throughout the project lifecycle.

Holiday Season

Essential Security and Safety Checks for a Hassle-free Holiday Season

Whatever your holiday plans may be, remember that awareness is the best defence. Taking a few minutes to review your insurance and safety preparations can go a long way in protecting you and your loved ones, allowing you to fully relax and enjoy the season.

Healthcare

Your Healthcare Financial Plan For 2025

Jacqui Nel, our Business Unit Head for Healthcare, unpacks aspects around medical aid and gap cover for families to consider in 2025. With various medical aids announcing their fee increases for 2025, many households may need to reconsider their healthcare planning to find an affordable option.

Risk & Innovation

Extreme Weather and Your Business

Extreme weather and shifting weather patterns impact many of the risks businesses face, making it essential for businesses to have access to data and tools to understand their exposure to climate perils, to develop risk mitigation strategies and unlock capital. Evolving regulatory requirements adds to the complexity, while workforce health and safety remains a primary directive when faced with severe weather conditions.

Cyber

Cyber Criminals Targeting Mobile Devices

As the threat landscape evolves, cybercriminals are adopting sophisticated business models, making your smartphone the easiest way in. With Malware-as-a-Service (MaaS) on the rise, it's crucial to stay protected.

Protect your mobile device with Aon and Cybersafe's new Zone Alarm Mobile Security App—designed to shield you from the latest threats.

Risk Management

White-Collar Crime on the Rise

In today’s sophisticated and digitised business environment, white-collar crime poses a growing threat to organisations of all sizes. Employees, cybercrime and social engineering are just some of the risks your business may face. Are you prepared?

Learn more about how to protect your business from these evolving threats and the role of risk management in optimising your risk transfer solution.

Contruction and Engineering

Surety, Bonds and Guarantees 101

In today's fast-paced business environment, trust is everything! Whether you're in construction, energy or logistics, having a surety bond or guarantee ensures your contractual obligations are met. Learn how these bonds protect your projects and help build trust with partners.

Construction and Engineering

Machinery Breakdown: Mitigation and Preparation

With sophisticated equipment playing a critical role in daily operations, the financial impact of a sudden breakdown is more significant than ever. From costly repairs to downtime, the ripple effects can be severe. That’s why mitigating these risks and preparing for the unexpected is crucial.

Learn more about how to protect your business.

E-Hailing

E-Hailing Insurance Coverage

Many e-hailing drivers don't realise their personal insurance doesn’t cover commercial activities. From accidental damage to passenger liability, you need a tailored solution! Aon provides coverage options specifically for drivers on platforms like Uber, Bolt, and Shesha. Protect yourself and your business.

Bespoke Business Insurance

Navigating the Risks of South Africa’s Construction Industry

South Africa's construction industry faces tough times—rising costs, delays and extortion are just the tip of the iceberg. With these challenges, proper insurance and risk management are more critical than ever. Yet, many sub-contractors are cutting corners, taking on minimal insurance cover. This leaves them exposed to huge risks and potential legal battles.

Personal Insurance

Guard Against Underinsurance

“In the event of a catastrophic loss, such as a flood or fires – events South Africa has experienced recently – you may need to replace all your household contents and possibly the entire structure,” says Mandy Barrett, of Aon South Africa.

Aquaculture

South Africa’s Burgeoning Aquaculture Industry

South Africa's aquaculture industry is still in its infancy, but growing steadily, built upon the cultivation of marine species such as mussels, abalone, prawns and oysters and freshwater species such as catfish, trout, crocodiles and tilapia.

Risk

Business Property Insurance & Fire Risk

A comprehensive fire protection system, including sprinkler systems, hydrants and hose reels, is crucial for mitigating fire risks. These systems are designed to suppress fires and protect lives and property. Learn why these systems are not just optional but legally required in many cases.

Retirement

The Two-Pot Retirement System

Current statistics show that a staggering 94% of South Africans will not be able to retire financially independent.

Always get the insights and advice of a professional broker to guide you to make the best decision for your retirement and to help you invest your money wisely so that your golden nest egg stretches as far as it possibly can. Find out more about the Two-Pot Retirement system.

Cyber

Property and Cyber Risks for SMEs

There's no one-size-fits-all approach to insurance for small businesses. Whether facing physical or cyber losses, the right insurance coverage is critical. Work with a professional risk advisor to develop strategies that transfer and manage risks effectively. Prepare for every conceivable scenario to keep your business running smoothly.

Cyber

AI vs Humans

With the advancement of AI, cyber threats will continue to evolve. The human element remains the weakest link in cybersecurity, with over half of cyber events expected to be human-caused by 2025. How is your organisation addressing the human factor in cybersecurity?

Risk

The Rise of Alternative Risk Financing Solutions

Balancing risk retention and transfer is crucial in today's complex insurance landscape. Alternative risk financing solutions like captives and aggregate funds allow businesses to retain more risk while securing better terms from insurers

Nuclear Energy

Applications and Safety of Nuclear Energy

Brandon Scholtz, one of our risk consultants, talks about the critical role that data and insights from previous nuclear incidents play in shaping the legislative and regulatory frameworks governing nuclear activities today.

Macadamia Processing

Stock Throughput Cover in Macadamia Processing

Macadamia processors require a niche and specialised insurance solution that protects the integrity and the quality of South African macadamia nuts from cradle to consumption. One such insurance solution comes in the form of Stock Throughput (STP) Cover which is a specialised insurance policy tailored for businesses involved in importing, distributing or exporting products and merchandise.

Risk & Innovation

Safeguarding Cargo Transport Amidst Rising Risks

In the cargo transport sector the growth of e-commerce, predicted to hit $6 billion by 2025, adds pressure, attracting crime syndicates targeting valuable cargo.

Our senior marine and aviation broker, Natalie Cooper, highlights the importance of understanding these risks and implementing strong risk management strategies.

Agribusiness

Building Agribusiness Resilience

Agribusinesses face many challenges, from rocketing commodity prices to digitalisation and climate change, shifting geopolitics and shifting consumer behaviour. These risks are complex and interconnected making it essential to take a much closer look at risk insurance.

Civil Unrest

2024: The Year of Elections and the Potential for Civil Unrest

South Africa joins over 60 countries that will head to the polls in 2024, with heightened risks for civil unrest reminiscent of July 2021 top of mind. In our latest article, we unpack supply chain risks, damage to property and business continuity management.

high-value investment

Insuring Art and Collectables

Insuring high-value investment pieces such as art and collectables goes beyond conventional coverage. The realm of insurance for collectables is highly specialised, offering customised coverage tailored to the unique nature of investment pieces.

Medical Malpractice Insurance

Why the Retroactive Date on Your Medmal Insurance Policy Matters

In her latest article, Samantha Varela, our senior legal risk advisor talks about medical malpractice insurance cover and the importance of your policy’s retroactive date:

Business Interruption

Navigating the Pitfalls and Risks of Business Interruption

Business interruption insurance presents a lifeline for businesses in crisis, safeguarding against revenue loss and enabling businesses to meet overheads and expenses such as rent, salaries and supplier payments. Does your business have a plan?

Opinion of Russell Davis

Top 10 risks facing the transportation and logistics sector

Russell Davis, our property manager at our broking centre unpacks the unique challenges the South African transportation sector faces, where infrastructure issues elevate business interruption and supply chain failure as top risks.

Employee Benefits

Unpacking the Complexity of an Employee’s Disability Claim

What happens if an employee becomes seriously ill or disabled whilst in employment, and lodges a successful disability claim? What is the impact of such a claim on their employment contract, and the rest of their employer-sponsored benefits?

Renewable Energy

Securing Financing for Renewable Energy Projects

Unlocking the potential of renewable energy projects requires more than just innovation; it demands strategic risk management. Jacques De Villiers, our head of commercial, sheds light on the importance of a pre-agreed insurance policy for de-risking challenges throughout the project lifecycle.

State of the Market

Aon South Africa Launches 2024 Insurance State of the Market Report

We launch our 2024 Aon State of the Market report, in which we unpack the economic, geopolitical and humanitarian events that shaped 2023 and are expected to continue to evolve in 2024.

Risk

Solar Fire Risks

Fire hazards are a considerable threat to solar power generation and battery energy storage. In his latest article, Andy Mizen, one of our senior risk consultants, delves into the six most prolific challenges that solar plants are faced with.

Risk

Better Risk Management Profiling Through Storytelling

With the aid of your insurance broker and risk advisor – your business can provide accurate chapters of your business story to influence positive risk profiling outcomes – both internally on your retentions and externally with your risk transfer model.

Trade credit

Trade and Insolvencies

Our trade credit specialist, Maria Teixeira, takes a closer look at the impact that macroeconomic and geopolitical dynamics are having on trade and insolvencies and how your business can mitigate the risk with comprehensive and consistent credit management.

SPORTS, RECREATION AND ENTERTAINMENT

Damage to Brand or Reputation Top Risk for the Sports and Entertainment Industry

In our latest Global Risk Management Survey, damage to brand and reputation is the top risk for the Sports, Recreation and Entertainment industry. This industry, deeply connected to image and consumer confidence, faces unique challenges in managing its reputation effectively

Renewable Energy

Insurance Sector to Act as Catalyst for The Hydrogen Market

Jacques De Villiers, our head of commercial, delves into the phenomenal impact that hydrogen can have on the renewable energy sector and how the insurance industry can act as a catalyst, in his latest article.

Risk

Riot Risk: Do You Have Enough Cover?

Our executive head of retail, Simon Baker, unpacks riot and political risk in the lead-up to national elections on 29 May 2024. According to Simon there has been a big increase in the cost of riot and political cover for businesses, as well as a reduction in the limits of indemnity following the 2021 riots. Find out more…

Risk

Top Risks Facing the Natural Resources Industry

In the lead-up to the 16th Africa Energy Indaba, taking place from 5 – 7 March 2024 at the Cape Town ICC, Jacques De Villiers, our general manager of commercial inland, takes a closer look at the top risks facing the natural resources industry in his latest insight piece.

Risk Management

The Golden Three E's of Risk Management

Craig Kent, our head of risk consulting, says implementing and maintaining effective, resilient and efficient risk mitigation solutions, pivots around three considerations about the business and the potential risks it could face. First, you need to know what risks can threaten the business, second you need to understand the various potential impacts/outcomes such an event can have; finally, you need to elect, implement and manage suitable risk mitigation strategies to best counter the exposures. Find out more:

ESG

Top Risks Facing the Mining Sector

Our global practice mining leader, Paul Pryor, spoke about the top risks facing the mining sector during a roundtable discussion at the 2024 Invest Africa Mining Series; Unpacking the complex, volatile and constantly shifting range of challenges the natural resources industry is faced with.

ESG

Driving Sustainable Development - Circularity & ESG in Mining

During the 2024 Invest Africa Mining Series, Bruce Dettling, our mining broking leader at Aon Risk Solutions (UK), spoke about ESG and circularity in the mining sector and the need to drive sustainable development that delivers positive climate and societal outcomes through effective risk management.

Aon Report

Number of Billion-Dollar Disasters in 2023 Highest on Record: Aon Report

Our 2024 Climate and Catastrophe Insight report examines the increasing frequency and severity of disruptive natural disasters around the world and how their resulting economic losses are protected.

Cyber and Professional Indemnity

Email Interception Fraud – are you covered?

Jenny Jooste, our client manager for cyber and professional indemnity technology, takes a closer look at email interception fraud, the many tactics that cybercriminals can employ to gain access to your email account and how you can protect your business.

Aon Global Client Network

Knowledge, processes and systems must be optimised for a complex task.

Thuli Majodina, our business unit head of Aon Global Client Network (AGCN) and regional controller for Sub-Sahara Africa, unpacks the complex topic of multinational insurance in her latest article.

Holiday Season

Handy insurance tips to consider before heading out for your well-deserved holiday.

Holiday vibes are in the air! As you plan for some quality relaxation this holiday season, it's important to consider some important safety and risk management measures to ensure that there are no surprises during your much-needed break.

RISK & INNOVATION

Review your insurance covers to make sure you are covered for severe weather

Parts of Johannesburg were battered on Monday, 13 November 2023 in a devastating hailstorm with golf ball-sized hailstones wreaking havoc. The frequency of severe weather storms is increasing at an accelerated pace with economic losses from natural disasters estimated at $ 313 billion in 2022 alone – with approximately 42 percent of losses covered by insurance, according to Aon’s 2023 Weather, Climate and Catastrophe Insight report.

People & Organisation

The state of South Africa’s mental well-being is a cause for concern

In her latest article, Jacqui Nel, our Business Unit Head of Healthcare, unpacks the state of South Africa’s mental well-being and how it is affecting the workplace.

ESG

Its origins and the factors contributing to its momentum

In her latest article, Angela Jack, our head of specialty solutions, takes a step back to examine the origins of Environmental, Social and Governance (ESG) issues and the factors that are contributing to its momentum.

Sports, Recreation and Entertainment

Climate Change in the World of Major Events

In his latest article, Philip Cronje, our business unit manager for sports, recreation and entertainment, unpacks the effect that climate change is having on the world of major events; and why cancellation and abandonment insurance is critical.

Risk Consulting

Risk Management Essential to Protect Your Business and Remain Efficiently Insured

In his latest article, Craig Kent, our head of risk consulting, explains why it is critical for business leaders and risk managers to realign their risk management interventions and strategies to ensure the insurability of their businesses.

Commercial Risk

Navigating the risks of your solar energy installation

Unprecedented levels of load-shedding have been the catalyst for a dramatic increase in solar energy installations. We unpack solar installations from a risk management perspective during its installation and the maintenance thereof once installed.

Business Insurance

The importance of having the correct BI covers in place

Being adequately prepared for major business interruption events has never been more crucial. Yolenda Makhathini unpacks the importance of having the correct business interruption covers in place in her latest article.

Sports, Recreation and Entertainment

A Marketing Tool for Golf Days

A hole-in-one is considered one of the most elusive but most wanted achievements in the golfing world, which is why marketers often offer a hole-in-one prize on a designated hole during a golf day. Philip Cronje, our sports, recreation and entertainment business unit manager, discusses hole-in-one prize indemnity cover and why it is crucial for marketers to consider at their next golf day.

Renewable Energy

Regaining energy security through renewable energy.

In his latest article, Jacques De Villiers our general manager for commercial inland, unpacks risk and insurance matters in a shifting energy market, looking at ways to regain energy security through renewable energy.

Business Insurance

Continuity planning is essential in this increasingly volatile environment

Anything is possible, and the severity of disruptions can be devastating, if not fatal, for businesses that do not plan with intent and focus. Find out why Business Continuity Management is more critical than ever.

Skills Development in the Insurance Industry

Professional advice is more crucial than ever in an increasingly complex risk environment – filling this skills gap needs new urgency.

While the shortage of skills in the insurance industry is not new, it is accelerating. It demands of every insurance player – big or small – to revisit their skills development strategies and succession planning to ensure that we can meet the risk demands of our clients and ensure the sector remains healthy with continued skills development and retention of great human talent.

Cyber Liability Insurance

Aon Survey Reveals Major Cyber Incidents Resulted in a Nine Percent Decrease in Shareholder Value

Companies of all sizes will find our 2023 cyber resilience report to be a resource and tool to help inform Cyber risk decision-making in 2023 and beyond. Cyber resilience is a journey, best navigated in partnership and through teamwork.

Managing Emerging Risks

Fire Loss Prevention: Onsite security officers play a critical role

While fire prevention may not be the primary responsibility of a security officer, they fulfil a critical role at any site operation when it comes to fire prevention, early detection and emergency response.

National Health Insurance

Finding a healthcare solution that serves all South Africans

Jacqui Nel, our Business Unit Head for Healthcare, unpacks the National Health Insurance (NHI) Bill that was passed by government on 12 June 2023. Many stakeholders in the healthcare industry are concerned as to what the implications are.

Intellectual Property

Rethinking Intellectual Property in a Digital World

As we move into an increasingly digital world where the concept of the metaverse (a single, shared, immersive, persistent, 3D virtual space) is slowly finding its origins, the perception of IP and how it is evolving in this new reality is pushing the boundaries on legislative rights, fundamentally changing the concept of what it means to own intellectual property and how to protect it.

Managing Emerging Risks

Nuclear Safety - Lessons Learnt from the Fukushima Nuclear Disaster

On Friday 11 March 2011, a magnitude 9.0 earthquake struck just off the East coast of Japan, causing a tsunami that claimed thousands of lives.

Personal Insurance

Safety tips for your alternative energy and water solutions

Many households are clamouring for alternative energy and water solutions to decrease their dependency from municipal suppliers. While solutions such as solar and gas are the most popular alternatives that consumers are turning to, each brings its own unique set of risks to be aware of and to manage.

Risk Management

Robust Risk Management Programs Protect Your Business Assets and Bottom Line

Effective risk management programs are critical to the success of any business. They help to ensure that business operations run smoothly and that risks are proactively pre-empted, managed and mitigated as far as possible. Effective risk management programs are particularly important when it comes to managing property risk.

Sports, Recreation and Entertainment

Cancellation and Abandonment Insurance

Advertising agencies and production companies run on pressured deadlines and tight budgets that require impeccable project management to stay on track. But what happens when things go wrong?

Business Property Insurance

The importance of declaring your insured assets correctly!

In his latest article, our head of risk consulting, Craig Kent, unpacks the fundamentals of business property insurance and why it is important to have accurate declared insured values.

E&O

Aon Publishes Insights on Cyber and E&O Market

Aon publishes insights on the cyber and E&O market in our latest report, identifying how the UK/EMEA region can capitalise on a buyer-friendly environment. Find out more…

Medical Malpractice

Medical Malpractice and Informed Consent

Medical malpractice is a legal concept that refers to the negligence or improper treatment of a patient by a healthcare professional, such as a doctor, nurse or other medical practitioner. When a healthcare provider fails to provide an adequate standard of care to a patient, resulting in harm or injury to the patient, it may be considered medical malpractice.

Risk & Innovation

Aon: Cybercrimes Act Report 2023

In its latest report, Aon South Africa unpacks the legislative changes to the cyber landscape in South Africa in relation to the Cybercrimes Act of 2020. The report takes a deep dive into the exposures and risks corporates are faced with and how these cyber risks impact their operations and balance sheet.

Sports, Recreation and Entertainment

Hosting an Event?

Philip Cronje, our Sports, Recreation and Entertainment Business Unit Manager takes a closer look at the risks involved in organising large scale events for organisers, sponsors, contractors, suppliers, staff members and promoters; and why event liability insurance is crucial.

Sports, Recreation and Entertainment

Managing the risks of celebrity sponsorship for your brand

In a world obsessed with the lifestyles of the rich and famous, big brands are increasingly signing up with famous A-listers to endorse their products and services. But what happens when sponsored celebs behave badly? Philip Cronje unpacks the risks of celebrity sponsorship and the value of death, disability and disgrace insurance in his latest article.

Environmental, social, and corporate governance

ESG Data: How Businesses can use Data to Gain an Edge

Laura Wanlass, our global head of ESG, says defining an effective ESG strategy is a journey that starts with the basics. She unpacks a strategic, data-driven approach to benchmarking, coordinating and governing that could help companies gain the insights they need to make better decisions around ESG in her latest article.

Bespoke Business Insurance

The Big Five Risks Facing the Hospitality Industry

As a tourist destination, South Africa has a great deal to offer, with many tourists flooding wildlife reserves and boutique lodges to experience an authentic African bush adventure. And while the hospitality industry gears to deliver a memorable experience, the potential remains for something to go wrong, especially when wild animals and the ‘Big Five’ are in the equation.

Bespoke Business Insurance

Construction And Engineering Insurance

Major construction projects are more likely to be undertaken by clients with a global footprint, attracting investors to local economic development projects. And while there is currently a strong focus on smaller commercial projects such as office blocks or manufacturing facilities, the investment is welcomed in an industry that remains under pressure.

Business Insurance

Business under-insurance is on the rise, especially among SMEs

Clayton Ellary, from our Commercial Risk Solutions team, says that small and medium commercial businesses are being hardest hit by business underinsurance. In the context of weather catastrophes such as fire and flood which often result in losses, underinsurance on property, plant, fleets, stock, machinery and business interruption will have potentially severe consequences for the balance sheet and the ability of the business to recover from an uninsured or underinsured loss. Find out more in Clayton’s latest article…

Insights

Aon Names Dr. Nolwandle Mgoqi as CEO for South Africa

We are excited to welcome Dr. Nolwandle Mgoqi our new CEO for Aon South Africa. Dr. Nolwandle has held various executive roles in the financial services sector, including most recently Chief Executive of Standard Insurance Limited and Head of Insurance for Standard Bank South Africa.

Risk & Innovation

Financing SA’s Renewable Energy Projects Starts with Appropriate Risk Management and Insurance Solutions

The focus on the renewable energy sector has never been higher, with South Africa besieged with overcoming the crippling impact of load shedding on households, businesses and the economy.

Personal Insurance

Gearing Your Insurance for your Child’s Education

The start of the academic year usually brings an avalanche of added costs for many parents sending their children to school or varsity. Besides tuition fees, textbooks, stationery, electronic devices such as smartphones, tablets, laptops, printers, uniforms, sports gear and musical instruments constitute a very hefty financial investment.

Risk & Innovation

Digital and Financial Risks Facing SMEs in 2023

In a constrained economic environment uncertainty abounds, and how your business responds to that uncertainty is key. Most businesses will have insurance to mitigate such risks.

Personal Insurance

Weather Catastrophes Highlight Perils of Underinsurance

South Africa is no stranger to the devastating losses of weather catastrophes. In the last few years, heavy rainfalls, flooding and wildfires have increased in frequency and intensity.

Medical Malpractice

Opinion on Medical Malpractice by Samantha Varela, Senior Legal Risk Advisor at Aon South Africa

There is never a better time to be more aware of risk management than now. In an increasingly litigious society, medical practitioners are urged to stay up to date and informed of all the rules that regulate the profession. At Aon, we understand that this is no easy task.

Business Insurance

Market Volatility Drives Demand for Payment Protection

Maria Teixeira, our Trade Credit Specialist says that “Trade credit insurance answers an important question: Whether you are dealing with a potential bad debtor or not. Isn’t that worth knowing?” Find out why trade credit insurance is vital in a constrained economy in her latest article.

Risk & Innovation

Aon: Global Insured Losses from Natural Disasters Exceeded $130 Billion in 2022, Driven by Second-Costliest Event on Record

Annual Weather, Climate and Catastrophe Insight report reveals $313 billion global economic loss from natural catastrophes. Prominence of droughts and heatwaves highlighted growing importance of these perils in a warming world.

People & Organisation

Aon South Africa is recognised as a Top Employer 2023 in South Africa

The 2023 Top Employers have been announced and Aon South Africa has been recognised as a Top Employer in South Africa for the sixth consecutive year. Being certified as a Top Employer showcases an organisation’s dedication to a better world of work and exhibits this through excellent People policies and practices.

Personal Insurance

Manage Your Personal Insurance Portfolio

As we face an increasingly tougher economic climate, many households are taking financial strain and tightening their purse strings to cope with the rising cost of living and soaring job insecurity. Faced with these financial pressures, there’s always the temptation to cut insurance costs in a bid to save money on what many view as a grudge purchase – until something goes wrong that is!

Personal Insurance

Top Tips to Keep the Holidays Festive and Your Assets Safe

The holidays are approaching at pace and most of us cannot wait for some much-needed R&R. Before you head out for that much-needed break, take a little time to make sure that your hard-earned and precious assets are correctly insured and secure.

Managing Emerging Risks

Personal Funds Protect

E-commerce has undergone a dramatic metamorphosis in recent years to the point where many of us cannot fathom a world without it! We unpack the inherent risks that come with the territory and how you can protect your personal bank account from fraudulent funds transfer activity.

Risk & Innovation

Show Stoppers

What happens when an event simply cannot go on? Philip Cronje, our Business Unit Manager in our Sport, Recreation and Entertainment division takes a closer look at various ‘show stoppers’ that could spell disaster for an event and how you can mitigate the risk.

Managing Emerging Risks

New Aon Research Shows Prepared Leaders Embrace Risk And Make Better Decisions During Economic Uncertainty

New Aon research shows prepared leaders embrace risk and make better decisions during economic uncertainty. Find out more about our 2022 Executive Risk Survey: "Making Better Decisions in Uncertain Times”

Risk & Innovation

Ransomware Isn’t Just About Data

With the frequency of ransomware attacks increasing, it is becoming more apparent that these attacks have shifted from being oriented around liability to a focus on disruption. That is the cyber criminals’ new goal: to disrupt businesses rather than just to extract data. In our latest article we take a closer look at this trend and what it means for your business.

People & Organisations

Reviewing another professional’s work can have liability ramifications

Did you know that reviewing another professional’s work can have liability ramifications? Sam Varela, our Senior Legal Risk Advisor unpacks this unique risk in her latest article.

Risk & Innovation

Navigating the costs and risks of a SARS’ tax audit

The frequency of tax audits has increased significantly in the last two years, and it is no longer a matter of if, but when you or your business will be audited by SARS. Ann Cloete takes a closer look at Aon’s new insurance solution called “Tax Risk Insurance” that will provide you with access to some of South Africa’s leading tax experts to represent your case when you need it most.

Risk & Innovation

The Complexity of Growing Cannabis

Growing export-quality cannabis comes with a long list of stringent requirements, especially when you are growing cannabis for medicinal use. Aon South Africa takes a closer look at various risk factors that need to be considered throughout the cannabis growing process.

People & Organisations

Aon and Studyportals to provide Insurance for International Students Across Europe

Aon and Studyportals are providing insurance for international students that are completing their studies on European shores across 29 countries as well as Switzerland and Turkey. The program is accepted by hundreds of universities and is fully compliant with Schengen visa regulations for the Erasmus+ Exchange Program and Internships abroad. Find out more...

Risk & Innovation

Cyber Loop: A Model for Sustained Cyber Resilience

There is nothing linear about cyber security. In fact, a strategic approach to cyber resilience is circular and interactive, and importantly — informed by data. To realise the promise of sustained cyber resilience, it is critical that stakeholders — across the business — come together to assess where they sit in the circular journey. Find out more.

Risk & Innovation

Buyer beware: Transacting ESG risks and rewards

Increasingly, dealmakers recognise that almost any acquisition brings with it a series of ESG risks that are, at the same time, highly material, hard to quantify and subject to shifting goalposts. With shareholders and regulators intensifying scrutiny of companies’ ESG practices, dealmakers are in a race against time to improve ESG diligence. Find out more about this evolving risk.

South African Market Trends

2022 Insurance State of the Market

In its 2022 Insurance State of the Market report, Aon South Africa unpacks key global insurance market trends as well as local trends that are affecting the insurance market in a volatile and unpredictable world. Insurers, looking to manage volatility, have already begun modifying coverage terms and conditions – including those related to cyber, terrorism, sanctions and war, pandemics as well as coverage territories.

Risk & Innovation

How the ‘E’ in ESG Impacts Directors’ & Officers’ Liability (D&O) Insurance

Environmental Social Governance (ESG) and Corporate Social Responsibility (CSR) concerns are becoming increasingly challenging for the professional services and wider insurance industry and have the potential to cause damage to reputation and brand to those companies providing advice or risk services to select industry sectors.

Risk & Innovation

Times are tough – don’t lose the protection of your insurance cover

Many South Africans are facing financial difficulties as the costs of living rise dramatically, fuel prices soar and the economic hangover of Covid-19 still looms large in many households and businesses.

Personal Insurance

The ins and outs of vehicle under-insurance

In her latest article, Mandy Barrett unpacks the financial ramifications of vehicle under-insurance and why it is important to ensure that you have sufficient cover in place for the full cost of a claim. Being better informed about current market conditions relating to used car prices, inflation and parts is why it is essential to review your sums insured.

Risk & Innovation

Treading the Tight Rope Between Cyber Risk Mitigation and Good Governance

In his latest article, Zamani Ngidi, our Cyber Solutions Client Manager takes a closer look at data privacy and the liability that emanates from cyber related crimes for all directors and officers. If an organisation suffers a cyber breach the directors and officers are likely to face investigation as to the IT governance and data privacy controls and whether these were up to standard as outlined by the King IV report and POPIA. Is your organisation prepared to navigate the risk?

Personal Insurance

Safeguard Your Golden Nest Egg

Retirement is a time for you to be enjoying a more relaxed pace of life, spending time with loved ones and friends and enjoying the fruits of your working career. However, retirees could be at risk of becoming victims of cybercrime fraudsters who are targeting your ‘nest egg’.

Risk & Innovation

Cyber Risks Facing the Retirement Industry

Contending with the intensity and frequency of cyber threats to business operations is a 24/7/365 challenge. While the banking sector has intensified its cyber defences, threat actors have set their sights on the retirement industry. Not only is the financial quantum at risk huge, but the wealth and sensitivity of personal data sitting within retirement funds places the employers, administrators and trustees of retirement plans at significant risk in an environment that is increasingly litigious.

Managing Emerging Risks

Commodity Price Risk and its Effect On SSA

In the early days of the COVID-19 pandemic, entire industries came to an abrupt halt. Border closings, as well as port and factory shutdowns, disrupted global supply chains, leading to severe scarcity of materials.

Managing Emerging Risks

Avoiding the financial ramifications of not having sufficient cover for a claim

Many businesses are faced with an increasingly volatile political and socio-economic climate. Not only are businesses having to manage a whirlwind of change and disruption in their business models, such as technology, changing consumer behaviour, socio-demographic shifts, climate change and the pandemic, but they’re also being confronted by a heavily constrained economy and rising inflation.

Risk & Innovation

Making digital tangible in M&A

Consumers’ and businesses’ accelerated flight to digital during the pandemic underscores the vital importance of technology to business competitiveness. Digitally enabled business models will account for an estimated 70% of new value created in the global economy in the next ten years, according to the World Economic Forum.

Managing Emerging Risks

Embracing new deal dynamics in public markets

Public markets are becoming harder for dealmakers to navigate due to a combination of factors. From the curious role played by special purpose acquisition companies (SPACs) to a revival of shareholder activism and more rigorous disclosure requirements, there is complexity at every turn.

People & Organisations

ESG catches up with financials in due diligence, says Aon

Aon, a leading global professional services firm, launched a report into value creation and risk in M&A, providing clear strategies for buy- and sell-side dealmakers to follow in light of the complex nature of M&A today.

Managing Emerging Risks

Shortage of Rental Vehicles Affecting the Insurance Industry

Like most businesses, car rental companies had to tighten the proverbial belt on all operational levels including fleet sizes as a result of the COVID-19 pandemic, causing severe shortages of rental vehicles.

Personal Insurance

Top Insurance Tips for Your Home Build or Renovation

Many families are having to contend with changing family and work structures such as taking care of elderly parents, grown children staying home for longer and working from home. These lifestyle changes are fuelling an increase in home renovations...

Business Insurance

The Importance of Professional Indemnity Insurance and Keeping Your Cover Current

No professional relishes the thought of making a mistake or being accused of being negligent in the execution of their professional duties. In fact, you may not even have made a mistake for a claim of negligence to be brought against you. However you’ll still need to defend any such claims to resolution, which can be a costly affair, both in time and financially.

Notable market updates

Aon Global Risk Management Survey

Aon’s 2021 Global Risk Management Survey polled more than 2,300 respondents in 60 countries across 16 industries at both public and private companies. The report highlights the top 10 risks by industry and region, as well as risk readiness, associated losses and mitigation actions for each of the top 10 risks. In addition, the report includes the predicted top 10 risks in the next three years and Aon’s analysis of underrated risks.

People & Organisations

ESG: Tick-box exercise or a true risk differentiator?

Although not new, Environmental, Social and Governance (ESG) issues have become a key focus in the last 18-24 months, in part driven by growing awareness of environmental and equity and inclusion issues, as well as the health and wellness impacts of COVID-19. The events of 2020 highlighted how ESG issues can become financial risks overnight.

Risk & Innovation

Unpacking Products Inefficacy Insurance

Products inefficacy insurance is an aspect of liability insurance which is sometimes overlooked or misunderstood. This may be because it is closely aligned, but different, from products liability insurance. Products inefficacy insurance is designed to cater for a very defined risk that operates alongside and in tandem with conventional products liability insurance cover.

Risk & Innovation

State Of the Market: Sports, Recreation and Entertainment

The Sports, Recreation and Entertainment (SRE) sector has been dealt a devastating blow by the Covid-19 pandemic. Two years in, the industry is finding its feet, rising above immense adversity and shifting gear to find innovative solutions in a world that has been changed, irrevocably.

Risk & Innovation

Aon 2021 Weather, Climate and Catastrophe Insight Report

Aon, a leading global professional services firm, published its 2021 Weather, Climate and Catastrophe Insight report, which evaluates the increasing frequency and severity of disruptive natural disasters and how their resulting economic losses are protected globally.

Managing Emerging Risks

A Brave New World of Work

The pandemic has shaken up the world of work across the globe with the work-from-home (WFH) and gig-economy phenomena becoming viable and increasingly popular options.

Personal Product Solutions

Insurance 101: Explaining terms commonly used in insurance

Making better decisions about your risk and insurance starts with having a clear understanding of the common terms and definitions used in your insurance policy. In its absence, many individuals may only discover a specific exclusion or condition of cover at claims stage which may adversely affect the outcome of a claim.

Managing Emerging Risks

Economic Slowdown or Slow Recovery a Top Threat in SSA

In 2020, when the COVID-19 pandemic cut a deadly swathe across the world, only 27 countries in the world experienced economic growth. Global economic growth dropped from an annual rate of –3.4 percent to –7.6 percent.

Risk & Innovation

The Cost of Weathering Climate Change for homeowners

Many global communities are exposed to increasingly volatile weather conditions that are in part enhanced by the growing effects of climate change. This includes record-setting episodes of extreme temperatures, rainfall and flooding, droughts and wildfires, rapidly intensifying tropical cyclones and late season severe convective storms.

People & Organisation

Aon South Africa recognised as a Top Employer 2022

The 2022 Top Employers have been announced by the Top Employer’s Institute, with Aon South Africa recognised as a Top Employer for an impressive fifth consecutive year.

Insights

Closing 2021 and Embracing a New Chapter

As we close off 2021 and as a new year beckons, it is understandable that we are all hoping for relief and a return of some normality – a ‘new better’. It seems fitting to acknowledge how far we have come and the tremendous ability we all possess to adapt and remain resilient despite the adversity. You have pivoted, you have realigned work and home life, many have completely reimagined business models and ways of work to find opportunity in the risks.

COVID-19 INSIGHTS

Long-COVID’s effect on the workplace

Most people who have contracted COVID-19 recover within two weeks, while those who have experienced acute infection can take up to six weeks to recover. Many people are, however, experiencing a wide range of symptoms beyond six weeks, often in excess of six months.

Personal Insurance

Top Tips to keep the holidays festive and your assets safe

Let’s face it – most of us cannot wait to see the back of 2021 - and are desperate for some much-needed R&R. Before you immerse yourself in the holidays, take a little time to make sure that your hard-earned and precious items are correctly insured and secure.

People & Organisations

Supporting emotional wellbeing in the workforce

The impact of mental health on workforce productivity is well recognised. Employers hold the key to supporting emotional and mental wellbeing in the workplace, but as businesses grow their workforces globally across geographies, how can employers provide holistic, cross-cultural health and wellbeing solutions that support hugely diverse workforces?

Risk & Innovation

Importance of Sasria Cover

With trade already heavily challenged by the COVID-19 pandemic, the recent wave of riots, looting and destruction of businesses in Gauteng and Kwa-Zulu Natal has exponentially exacerbated matters, presenting a tipping point for many businesses as to whether they survive or not. The violent and destructive protest action is not, however, unique to South Arica with Aon’s 2021 Risk Maps finding that persistent political instability and unrest is slowing global economic rebound in the face of the ongoing pandemic.

Risk & Innovation

Claims automation and innovation are key in client experience and satisfaction

In Aon’s 2021 Global Risk Management survey, failure to innovate or meet client needs was pegged as the #10 risk facing businesses around the globe. The COVID-19 pandemic and subsequent global lock-downs have magnified the need for digital technology solutions to drive operational efficiencies and deliver service to clients.

Risk & Innovation

2021’s Top 10 Risks

With ransomware attacks filling the headlines and the COVID-19 pandemic pushing organisations to embrace remote working and online business models, cyber security has become a top-of-mind concern for many business leaders. It should come as no surprise, then, that cyber-attacks and data breaches rank first on the list of the top 10 risks in Aon’s 2021 Global Risk Management Survey.

Specialty Business Insurance

Top 10 risks facing the construction industry

The construction industry has been navigating a challenging landscape due to the economic slowdown caused by the COVID-19 pandemic. The sector has historically been highly sensitive to economic cycles that have been compounded by government-sanctioned lockdowns, leading to the delay, suspension and cancellation of projects around the globe.

Cyber Insurance

Consider These 10 Critical Steps to Prevent and Detect Ransomware Threats

Aon’s Cyber Security Risk Report found that ransomware is a crisis that will only get worse as threat actors continue to grow in sophistication and expertise. Ransomware attackers often operate with the discipline and approach of a legitimate traditional business, except with criminal intent. Fortunately, there are strategies companies can take to reduce the risk of falling victim to a ransomware attack.

Cyber Insurance

Aon launches Ransomware Defence to address growing challenges around cyber insurability

Ransomware Defence brings Aon’s cyber security expertise and capabilities together into one solution to help mid-market organisations improve and demonstrate their cyber preparedness. This offering can help a client mitigate their risk of a ransomware attack while also facilitating their cyber insurance placement.

Business Insurance

Cyber Criminals Target Intellectual Property

Theft, misappropriation or infringement of intellectual property (IP) – assets that lack physical substance such as patents, trademarks, copyrights, data rights and trade secrets – poses a significant and growing risk to organisations. IP is core to innovation and business growth, and with cyber incidents targeting IP on the rise, the danger of brands and IP being hijacked by cybercriminals is rapidly escalating.

Personal Insurance

How to save on insurance premiums without compromising on cover

Amidst the ongoing pandemic, many households are taking financial strain and tightening their purse strings to cope with the rising cost of living and soaring job insecurity. Faced with these financial pressures, there’s always the temptation to cut insurance costs in a bid to save money on what many view as a grudge purchase – until something goes wrong that is!

Personal Insurance

Cellphone Snatching on the Rise

Opportunistic crime is on the rise and so is the trend of cellphone snatching Brazen criminals are willing to risk life and limb to snatch a R20k smart phone and make off with it - phones left on tables right next to you in restaurants, in vehicles hooked up to car kits, peeping out of back pockets, and even while in use and against your ear – its all fair game to criminals who will accost anyone to get their hands on a smartphone payday.

Personal Insurance

Correctly Insuring Art and Collectables

The art and collectables industry has undergone somewhat of an evolution amidst the ongoing COVID-19 pandemic, with the industry taking the viewing and purchasing of artwork onto digital platforms. This has also opened the market from a global perspective, allowing art enthusiasts from anywhere in the world to participate in the growing art craze.

Opinion by Nyasha Madzingira

The effects of climate change on South Africa’s insurance industry

Climate change is a hotly debated environmental risk and with a marked increase in the frequency and severity of extreme weather events as outlined by Aon’s Annual Catastrophe Report, there is a rising concern that weather catastrophes will impact the sustainability of insurance businesses.

Risk & Innovation

Property risks associated with under-utilised properties

Due to government’s efforts to halt the spread of the COVID-19 virus, South Africa has undergone various levels of government-sanctioned lockdowns. As a result, many businesses have had to adapt its business operations, allowing staff members to work from home. As the work-from-home wave grows, more companies are rethinking their office space and utilising less, leaving property owners to rethink the use of space.

Healthcare & Employee Benefits

Financially navigating a critical illness

Few people consider the far-reaching implications of a health crisis on every facet of their lifestyle. The devastating effect of a serious health crisis such as cancer, a stroke or heart attack, COVID-19 or even an accident typically extends far beyond the physical consequences of such an event, with significant implications for your financial and emotional wellbeing too, and even your ability to work and earn an income.

Business Insurance

What the gig economy means for your business insurance

Not only is the gig economy benefiting individuals, but businesses are also embracing this technologically enabled approach to unlock new revenue streams. Some small business owners have successfully used it to secure new clients, while millennials are particularly open to this model of working from a flexibility perspective.

Personal Insurance

Addressing fire risks in and around your home

Fire is one of the major causes of outright insured losses in South Africa, yet it is also one of the most underestimated and underinsured risks. Your home and everything in it are likely to constitute your single biggest investment, so make sure you take all the necessary fire mitigation steps, and that you are correctly insured for a worst-case scenario.

Political Risk Maps

Aon’s 2021 Risk Maps: persistent political instability and unrest slowing global economic rebound

Aon, a leading global professional services firm providing a broad range of risk, retirement and health solutions, has published its 2021 Risk Maps report, which finds that the COVID-19 pandemic both suppressed and aggravated terrorism and political violence risks in 2020-2021. The scale of government intervention, economic inequality and public unrest about government responses to the COVID-19 pandemic will continue to play an influential part in growing global unrest.

Business Insurance

Supply Chain Interrupted

The violent and destructive protest action of the last few days has thrown supply chain risk into stark contrast yet again, with businesses scrambling to secure the weak links, safeguard lives and property and reduce the risks to business continuity as far as possible.

Business Insurance

Cyber Criminals Target Intellectual Property

Theft, misappropriation or infringement of intellectual property (IP) – assets that lack physical substance such as patents, trademarks, copyrights, data rights and trade secrets – poses a significant and growing risk to organisations.

Insights

Aon's Credit Market Insights Report Q2 2021

Read the mid-year 2021 credit market insights from Aon’s thought leaders related to global credit insurance market trends, placements and claims dynamics

Personal Insurance

Insurance Tips for First-Time Vehicle Buyers

There’s nothing quite like buying your first car. While it is exciting, it could also be overwhelming to address the insurance aspect of securing your vehicle against theft, loss or damage. There are so many variations of cover and costs available.

Personal Insurance

Top nine risks to consider if you are working from home

According to Aon South Africa, insurance brokerage and risk advisors, while your business may now be based at home, the risks it faces are very much in the business realm. There are a number of important aspects to consider from an insurance and risk perspective when working from home.

Risk & Innovation

Health Trends and the Impact on Workforces

Social restrictions, remote working and the impact of reduced physical activity has raised awareness of issues like emotional and social wellbeing and what this means for employees. With the impact of the pandemic set to be long-term, and many work models becoming the norm and not bouncing back to pre-COVID-19 models, it’s important that business leaders reinvent the approaches to employee health, safety and wellbeing.

Risk & Innovation

Need for Environmental Insurance

Exposure to environmental litigation is an issue that companies are increasingly expected to deliver on as awareness of climate change increases. Whether it is driven by legislative requirements, a need to economise on resources or considerable media coverage of the issue, it is clear that being kinder to our planet is becoming a board requirement.

Personal Insurance

The real cost of car theft

While insurance is an essential aspect of recovering financially from vehicle theft, there are still unexpected costs you may not have planned for, and some which you cannot attach a monetary value to.

South African market trends

2021 Insurance State of the Market

Business leaders have been confronted with a number of decisions as they steer their workforces, operating models, customers, portfolios and finances through massive uncertainty. Some of the changes are likely to last — and some are poised to completely reshape parts of their business. In the case of risk, COVID-19 has pushed companies to reprioritise risk and resilience.

Notable market updates in EMEA

Global Insurance Market Insights

Aon plc (NYSE:AON), a leading global professional services firm providing a broad range of risk, retirement and health solutions, released its Quarter 1 Global Market Insights with notable market updates for the Europe, the Middle East and Africa (EMEA) region.

Business Insurance

Machinery Breakdown – Is your business covered?

If your business relies on high-value or specialist machinery in its daily operations and service/product delivery, the breakdown of such machinery can incur significant losses - not only from a repair or replacement perspective, but also in terms of business interruption losses and reputational damage incurred during down time.

Business Insurance

Is your insurance still up to the task of mitigating your SME risks?

When you’re in the thick of running your business and tending to day-to-day work responsibilities, it’s easy to leave aspects such as risk and insurance simply to ‘tick’ over, but that could leave you compromised as your business evolves and the exposures in your environment and industry change.

Aon Insights

Insurance & Data Privacy Report

Evolving cyber risks and the Protection of Personal Information Act (POPIA) has created a greater awareness of the financial impact of cyber risks, considering the fact that maximum penalties under POPIA are a R10 million fine or imprisonment for a period not exceeding 10 years or both[1]. It emphasises the need for organisations to increase their understanding of cyber insurance.

Risk & Innovation

The Pandemic’s effect on the SRE Sector

The Sports, Recreation and Entertainment (SRE) industry has been one of the hardest hit by the pandemic with large parts of the industry still fighting to survive. Aon’s global COVID-19 Risk Management and Insurance Survey, conducted at the end of 2020, sheds some light onto the SRE sector’s response to the pandemic.

Risk & Innovation

Navigating the Energy Crisis

According to a new report by the Council for Scientific and Industrial Research (CSIR) on SA’s electricity crises and ongoing load shedding, South Africa will grapple with an electricity supply gap until 2022, in a best-case scenario. Load shedding will be a regular feature for the foreseeable future.

Risk & Innovation

Major Shift in D&O Claims

Historically, Directors and Officers liability insurance (D&O) catered for low frequency/high severity risks. The D&O market has, however, experienced a fundamental shift to high frequency/high severity claims for damages and judgements, in addition to an increase in high frequency/low severity claims for defence costs, regulatory investigations and enquiries.

Risk & Innovation

Insurance Cover for Cycling Fanatics

Cycling became a lifeline for countless South Africans during the various lockdowns in the past year, offering a means to stretch those legs and relieve some stress. Many cyclists however underestimate the financial implications of having to replace lost or damaged pedal cycles and gear with top of the range cycles costing as much as R250k.

Risk & Innovation

Five Risk Trends Affecting SMMEs

The world certainly looks very different a year later, and nowhere is it more apparent than in the Small, Medium and Micro Enterprises (SMME) space. The sector has faced more than its fair share of obstacles during the COVID-19 pandemic amidst a contracting economy and lockdown measures that reduced income streams to a trickle.

Risk & Innovation

Flooding on the Cards

With above normal rainfall[1] predicted for South Africa until April, flooding could be a reality for many South Africans in 2021. In Aon’s Weather, Climate and Catastrophe 2020 Report, flooding was identified as the second largest peril across the globe, following tropical cyclones, with a devastating cumulative economic loss of $1,191bn (R17,674bn). What is even more concerning is the fact that only 17% of losses were insured.

People & Organisations

Getting Through – Not To - Retirement

Even before the pandemic, many South Africans were already facing significant constraints in saving enough for their retirement. This trend has been exacerbated by the pandemic as workers face reduced earnings, either due to reduced work hours or retrenchment.

Risk & Innovation

The Pandemic’s effect on the Technology, Media and Telecom Sector

Aon’s global COVID-19 Risk Management and Insurance Survey, conducted at the end of 2020, found interesting insights into the Technology, Media and Telecom (TMT) sector’s response to the pandemic. Half of survey respondents in this industry were from North America and EMEA (Europe, Middle-East and Africa).

Risk and Innovation

Reprioritising Risk & Resilience

Our recent survey evaluated how companies responded to COVID-19 their priorities for reshaping their business, and implications for risk and inurance.

People & Organisation

Aon South Africa recognised as a Top Employer 2021

Aon South Africa has been certified as a Top Employer for the fourth consecutive year by the Top Employer’s Institute.

Personal Product Solutions

Insuring Student Assets

Mandy Barrett of insurance brokerage and risk advisors, Aon South Africa, offers parents the following invaluable tips when it comes to insuring student assets.

Personal Product Solutions

Insurance 101

When obtaining an insurance quote, it may seem like you’re drowning in an alphabet soup of terminology, but once you understand the key terms and why they are so important, it all becomes a lot clearer. Aon provides an overview of some of the most common, and important insurance terms that you may encounter in your insurance dealings.

Risk & Innovation

The Ransomware Epidemic

The recent SolarWinds debacle5 highlights the fact that billions of Rands of IT security can be undermined by one weak entry point, an example of the ingenuity of criminal attackers and their methods to obtain access. Aon offers seven tips to help mitigate the risk of falling victim to ransomware and better prepare for a ransomware incident.

Risk & Innovation

What the Pandemic Taught us

Opinion by Craig Kent, Head of Risk Management at Aon South Africa

No matter which way you approach it, COVID-19 has fundamentally changed the parameters for business of what constitutes success in the future, and how risks will be measured and mitigated.

People & Organisations

Supporting emotional well-being in the workforce

The impact of mental health on workforce productivity is well recognised. Employers hold the key to supporting emotional and mental wellbeing in the workplace, but as businesses grow their workforces globally across geographies, how can employers provide holistic, cross-cultural health and wellbeing solutions that support hugely diverse workforces?

Keys to Managing COVID-19

Construction sector is critical to SA’s post-COVID economic recovery

Traditionally, the development of risk management plans is tailored to address assessed and quantified risks. There is however always the ‘the unknown factor’. Enter the COVID-19 pandemic. Of course, we have faced localised pandemics before, but never one on such a globally synchronous scale, thanks to global travel and trade. It propelled the entire world into unchartered territory as mass economic and travel lockdowns were implemented, and contingency plans were hurriedly rolled out.

Managing Emerging Risks

Cyber attackers hone in on South African businesses

Ransomware industry flourishes in SA while business are largely unprepared for the business interruption and financial fallout of a breach

Managing Emerging Risks

Navigating a changing insurance market

Cyber has become the latest battle front in times of geopolitical conflict. Here's how organizations can take steps to improve their cyber defenses.

Managing Emerging Risks

Liability Claims – When to Notify?

In situations of liability, it is better to be safe than sorry. Capture all circumstances in respect of which you have an awareness of the possibility, however remote, that a claim might arise, and notify your insurer or broker in writing as quickly as possible

Rising Health & Retirement Costs

Why You Need Gap Cover

Without supplementary cover, members potentially face large shortfalls between their medical scheme benefits and the actual costs incurred for surgery or other in-hospital treatment.

Managing Emerging Risks

Guard against under-insurance

Having a solid understanding of the implications of underinsurance is crucial at a time when many South Africans are financially strained and looking for ways to save on household costs